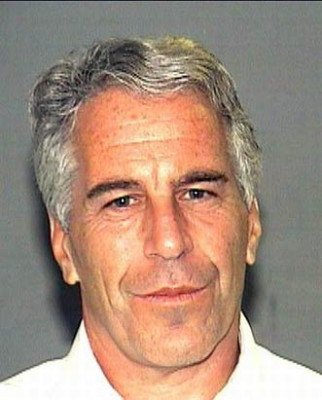

Age, Biography, and Wiki

His Wikipedia page details his rise to prominence as well as his criminal activities and legal troubles, including convictions for sex offenses and sex trafficking. He was arrested again in 2019 on federal charges of sex trafficking of minors and died by suicide in a federal jail in Manhattan.

| Occupation | Criminals |

|---|---|

| Date of Birth | 20 January 1953 |

| Age | 73 Years |

| Birth Place | New York City, U.S. |

| Horoscope | Capricorn |

| Country | U.S |

| Date of death | 10 August, 2019 |

| Died Place | Metropolitan Correctional Center, New York City, U.S. |

Height, Weight & Measurements

There is no authoritative public record of Jeffrey Epstein’s height, weight, or body measurements. Media coverage and photos suggest he was of average height and build for an adult male, but specific figures have not been confirmed.

| Height | |

| Weight | |

| Body Measurements | |

| Eye Color | |

| Hair Color |

Dating & Relationship Status

Jeffrey Epstein was never married and had no children. His personal life was marked by secrecy and controversy, and he was known for his associations with wealthy and powerful individuals. There have been no public statements or confirmed relationships beyond these associations.

His parents Pauline "Paula" Stolofsky (1918–2004) and Seymour George Epstein (1916–1991) were Jewish and had married in 1952 shortly before his birth. Pauline worked as a school aide and was a homemaker. "Paula was a wonderful mother and homemaker, despite the fact that she had a full-time job", according to a former childhood friend of Epstein's. Seymour worked for the New York City Department of Parks and Recreation as a groundskeeper and gardener. Jeffrey was the older of two siblings; he and his brother Mark grew up in the working-class neighborhood of Sea Gate, a private gated community in Coney Island, Brooklyn. Epstein was referred to as "Bear" by his parents while Mark was known as "Puggie". Neighbors described the Epstein family as being, "so gentle, the most gentle people".

In August 1981, Epstein founded his own consulting firm, Intercontinental Assets Group Inc. (IAG), which assisted clients in recovering stolen money from fraudulent brokers and lawyers. Epstein described his work at this time as being a high-level bounty hunter. He told friends that he worked sometimes as a consultant for governments and the very wealthy to recover embezzled funds, while at other times he worked for clients who had embezzled funds. Spanish actress and heiress Ana Obregón was one such wealthy client, whom Epstein helped in 1982 to recover her father's millions in lost investments, which had disappeared when Drysdale Government Securities collapsed because of fraud.

The only publicly known billionaire client of Epstein was Leslie Wexner, chairman and CEO of L Brands (formerly The Limited, Inc.) and Victoria's Secret. In 1986, Epstein met Wexner through their mutual acquaintances, insurance executive Robert Meister and his wife, in Palm Beach. A year later, Epstein became Wexner's financial adviser and served as his right-hand man. Within the year, Epstein had sorted out Wexner's entangled finances. In July 1991, Wexner granted Epstein full power of attorney over his affairs. The power of attorney allowed Epstein to hire people, sign checks, buy and sell properties, borrow money, and do anything else of a legally binding nature on Wexner's behalf. Epstein managed Wexner's wealth and various projects such as the building of his yacht, the Limitless.

Epstein installed concealed cameras in numerous places on his properties to allegedly record sexual activity with underage girls of prominent people for criminal purposes such as blackmail. Ghislaine Maxwell, Epstein's long-term girlfriend and companion, told a friend that Epstein's private island in the Virgin Islands was completely wired for video and the friend believed that Maxwell and Epstein were videotaping everyone on the island as an insurance policy. When police raided his Palm Beach residence in 2006, two hidden cameras were discovered in his home. It was also reported that Epstein's mansion in New York was wired extensively with a video surveillance system.

| Parents | |

| Husband | |

| Sibling | |

| Children |

Net Worth and Salary

Epstein was notorious for his high-profile social network, which included politicians, business magnates, and members of royalty. His associations brought scrutiny and controversy both during his life and after his death. Despite the notoriety, there is no official social media presence for Jeffrey Epstein, nor is there a verified account maintained by his estate.

Epstein also stated to some people at the time that he was an intelligence agent. During the 1980s, Epstein possessed an Austrian passport that had his photo, but with a false name. The passport showed his place of residence as Saudi Arabia. In 2017, "a former senior White House official" reported that Alexander Acosta, the U.S. Attorney for the Southern District of Florida who had handled Epstein's criminal case in 2008, had stated to interviewers of President Donald Trump's first transition team: "I was told Epstein 'belonged to intelligence' and to 'leave it alone'", and that Epstein was "above his pay grade".

In 1988, while Epstein was still consulting for Hoffenberg, he founded his financial management firm, J. Epstein & Company. The company was said by Epstein to have been formed to manage the assets of clients with more than US$1billion in net worth, although others have expressed skepticism that he was restrictive of the clients that he took.

In 1996, Epstein changed the name of his firm to the Financial Trust Company and, for tax advantages, based it on the island of St. Thomas in the U.S. Virgin Islands. By relocating to the U.S. Virgin Islands, Epstein was able to reduce federal income taxes by 90 percent. The U.S. Virgin Islands acted as an offshore tax haven, while at the same time offering the advantages of being part of the United States banking system.

Career, Business, and Investments

Other investments included private jets and various financial holdings, many of which were managed through secretive structures and offshore entities.

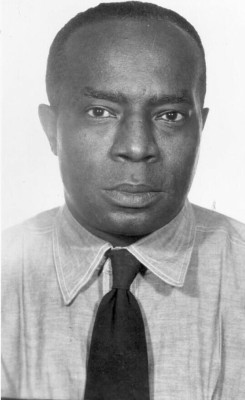

Jeffrey Edward Epstein (January 20, 1953 – August 10, 2019) was an American financier and child sex offender. Born and raised in New York City, Epstein began his professional career as a teacher at the Dalton School, despite lacking a college degree. After his dismissal from the school in 1976, he entered the banking and finance sector, working at Bear Stearns in various roles before starting his own firm. Epstein cultivated an elite social circle and procured many women and children whom he and his associates sexually abused.

Epstein allegedly showed inappropriate behavior toward underage female students at the time, paying them constant attention, and even showing up at a party where young people were drinking, according to a former student. Other former students also often saw him flirting with female students. Eventually, Epstein became acquainted with Alan Greenberg, the chief executive officer of Bear Stearns, whose son and daughter were attending the school. Greenberg's daughter, Lynne Koeppel, pointed to a parent-teacher conference where Epstein influenced another Dalton parent into advocating for him to Greenberg. In June 1976, after Epstein was dismissed from Dalton for "poor performance", Greenberg offered him a job at Bear Stearns.

Steven Hoffenberg hired Epstein in 1987 as a consultant for Towers Financial Corporation (unaffiliated with the company of the same name founded in 1998, and acquired by Old National Bancorp in 2014), a collection agency that bought debts people owed to hospitals, banks, and phone companies. Hoffenberg set Epstein up in offices in the Villard Houses in Manhattan and paid him US$25,000 per month for his consulting work.

In 1993, Towers Financial Corporation imploded when it was exposed as one of the biggest Ponzi schemes in American history, losing over US$450million of its investors' money. In court documents, Hoffenberg claimed that Epstein was intimately involved in the scheme. Epstein left the company by 1989 and was never charged for involvement in the massive investor fraud committed. It is unknown if Epstein acquired any stolen funds from the Towers Ponzi scheme.

By 1995, Epstein was a director of the Wexner Foundation and Wexner Heritage Foundation. He was also the president of Wexner's Property, which developed part of the town of New Albany outside Columbus, Ohio, where Wexner lived. Epstein made millions in fees by managing Wexner's financial affairs. Although never employed by L Brands, he frequently corresponded with the company executives. Epstein often attended Victoria's Secret fashion shows, and hosted the models at his New York City home, as well as helping aspiring models get work with the company.

In 2003, Epstein bid to acquire New York magazine. Other bidders included advertising executive Donny Deutsch, investor Nelson Peltz, media mogul and New York Daily News publisher Mortimer Zuckerman, and film producer Harvey Weinstein. The ultimate buyer was Bruce Wasserstein, a longtime Wall Street investment banker, who paid US$55million.

Epstein was the president of the company Liquid Funding Ltd. between 2000 and 2007. The company was an early pioneer in expanding the kind of debt that could be accepted on repurchase, or the repo market, which involves a lender giving money to a borrower in exchange for securities that the borrower then agrees to buy back at an agreed-upon later time and price. The innovation of Liquid Funding, and other early companies, was that instead of having stocks and bonds as the underlying securities, it had commercial mortgages and investment-grade residential mortgages bundled into complex securities as the underlying security.

Liquid Funding was initially 40percent owned by Bear Stearns. Through the help of the credit rating agencies—Standard & Poor's, Fitch Ratings and Moody's Investors Service—the new bundled securities were able to be created for companies so that they got a gold-plated AAA rating. The implosion of such complex securities, because of their inaccurate ratings, led to the collapse of Bear Stearns in March 2008 and set in motion the 2008 financial crisis and the subsequent Great Recession. If Liquid Funding were left holding large amounts of such securities as collateral, it could have lost large amounts of money.

Between 2002 and 2005, Epstein invested $80million in the D.B. Zwirn Special Opportunities Fund, a hedge fund that invested in illiquid debt securities. In November 2006, Epstein attempted to redeem his investment after he was informed of accounting irregularities in the fund. By this time, his investment had grown to $140million. The D.B. Zwirn fund refused to redeem the investment. Hedge funds that invest in illiquid securities typically have years-long "lockups" on their capital for all investors and require redemption requests to be made in writing 60 to 90 days in advance. The fund was closed in 2008, and its remaining assets of approximately $2billion, including Epstein's investment, were transferred to Fortress Investment Group when that firm bought the assets in 2009. Epstein later went to arbitration with Fortress over his redemption attempt. The outcome of that arbitration is not publicly known.

On April 18, 2007, an investor in the fund, who had $57million invested, discussed redeeming his investment. At this time, the fund had a leverage ratio of 17:1, which meant for every dollar invested there were seventeen dollars of borrowed funds; therefore, the redemption of this investment would have been equivalent to removing $1billion from the thinly traded CDO market. The selling of CDO assets to meet the redemptions that month began a repricing process and general freeze in the CDO market. The repricing of the CDO assets caused the collapse of the fund three months later in July, and the eventual collapse of Bear Stearns in March 2008. It is likely Epstein lost most of this investment, but it is not known how much was his.

By the time that the Bear Stearns fund began to fail in May 2007, Epstein had begun to negotiate a plea deal with the U.S. Attorney's Office concerning imminent charges for sex with minors. In August 2007, a month after the fund collapsed, the U.S. attorney in Miami, Alexander Acosta, entered into direct discussions about the plea agreement. Acosta brokered a lenient deal, according to him, because he had been ordered by higher government officials, who told him that Epstein was an individual of importance to the government. As part of the negotiations, according to the Miami Herald, Epstein provided "unspecified information" to the Florida federal prosecutors for a more lenient sentence and was supposedly an unnamed key witness for the New York federal prosecutors in their unsuccessful June 2008 criminal case against the two managers of the failed Bear Stearns hedge fund. Alan Dershowitz, one of Epstein's Florida attorneys on the case, told Fox Business Network "We would have been touting that if he had [cooperated]. The idea that Epstein helped in any prosecution is news to me."

In 2015, the Israeli newspaper Haaretz reported that Epstein invested in the startup Reporty Homeland Security (rebranded as Carbyne in 2018). The startup was connected with Israel's defense industry. It was headed by former Israeli Prime Minister Ehud Barak, who was also at one time the defense minister, and chief of staff of the Israeli Defense Forces (IDF). The CEO of the company is Amir Elihai, a special forces officer, and Pinchas Bukhris, a director of the company and former defense ministry director general and commander of IDF cyber unit 8200. Epstein and Barak, the head of Carbyne, were close, and Epstein often offered him lodging at one of his apartment units at 301 East 66th Street in Manhattan. Epstein had past experience with Israel's research and military sector. In April 2008, he went to Israel and met with a number of research scientists and visited different Israeli military bases.

Education

Jeffrey Epstein attended Lafayette High School in Brooklyn. He studied physics at Cooper Union for two years but left before completing a degree. He also briefly attended New York University’s Courant Institute of Mathematical Sciences, but again did not graduate.

Epstein attended local public schools, first attending Public School 188, and then Mark Twain Junior High School nearby and usually earned money by tutoring classmates. Acquaintances considered Epstein "sweet and generous", although "quiet and nerdy", and nicknamed him "Eppy". "He was just an average boy, very smart in math, slightly overweight, freckles, always smiling", a female friend later said.

In 1967, Epstein attended the National Music Camp at the Interlochen Center for the Arts. He began playing the piano when he was five, and was regarded as a talented musician by friends. He graduated in 1969 from Lafayette High School at age 16, having skipped two grades. Later that year, he attended advanced math classes at Cooper Union until he changed colleges in 1971. From September 1971, he attended the Courant Institute of Mathematical Sciences at New York University studying mathematical physiology, but left without receiving a degree in June 1974.

At age 21, Epstein started working in September 1974 as a physics and mathematics teacher for teens at the Dalton School on the Upper East Side of Manhattan. Donald Barr, who served as the headmaster until June 1974, was known to have made several unconventional recruitments at the time, although it is unclear whether he had a direct role in hiring Epstein. Three months after Barr's departure, Epstein began to teach at the school, despite his lack of credentials.

The Federal Bureau of Investigation (FBI) then became involved. Subsequently, the police alleged that Epstein had paid several girls to perform sexual acts with him. Interviews with five alleged victims and seventeen witnesses under oath, a high-school transcript and other items found in Epstein's trash and home allegedly showed that some of the girls involved were under 18, the youngest being 14, with many under 16. The police search of Eps