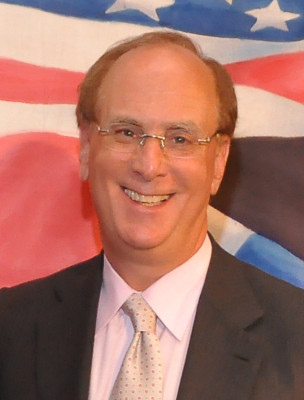

Age, Biography, and Wiki

Larry Fink was born on November 2, 1952, in Van Nuys, California. As of 2025, he is 72 years old. His early life was marked by a modest upbringing in a middle-class Jewish family. Fink's educational background includes a Bachelor of Arts in Political Science from UCLA, followed by an MBA in Real Estate from UCLA's Anderson School of Management.

| Occupation | Billionaire |

|---|---|

| Date of Birth | 2 November 1952 |

| Age | 73 Years |

| Birth Place | Los Angeles, California, U.S. |

| Horoscope | Scorpio |

| Country | U.S |

Height, Weight & Measurements

There is no publicly available information on Larry Fink's height, weight, or other measurements.

| Height | |

| Weight | |

| Body Measurements | |

| Eye Color | |

| Hair Color |

Dating & Relationship Status

Fink is married to Lori Weider Fink, and they have three children together.

He grew up as one of three children in a Jewish family in Van Nuys, California. His mother Lila (1930–2012) was an English professor and his father Frederick (1925–2013) owned a shoe store. He earned a BA in political science from UCLA in 1974. Fink was also a member of Kappa Beta Phi. He then received an MBA in real estate at the UCLA Anderson School of Management in 1976.

Fink has been married to his wife Lori Weider, his high-school sweetheart since 1974. The couple have three children. Joshua, their eldest son, was CEO of Enso Capital, a now defunct hedge fund in which Fink had a stake.

| Parents | |

| Husband | Lori Weider (m. 1974) |

| Sibling | |

| Children |

Net Worth and Salary

As of 2025, Larry Fink's net worth is estimated to be around $1.3 billion, reflecting his successful tenure as BlackRock's CEO. His compensation package includes a mix of salary and stock options, which contribute significantly to his wealth.

Laurence Douglas Fink (born November 2, 1952) is an American billionaire businessman. He is a co-founder, chairman and CEO of BlackRock, an American multinational investment management corporation. BlackRock is the largest money-management firm in the world with more than US$10 trillion in assets under management. In April 2024, Fink's net worth was estimated at US$1.2 billion according to Forbes. He sits on the board of the World Economic Forum. In 2025, Time magazine listed him as one of the world's 100 most influential people.

Fink started his career in 1976 at First Boston, a New York-based investment bank, where he was one of the first mortgage-backed security traders and eventually managed the firm's bond department. At First Boston, Fink was a member of the management committee, a managing director and co-head of the Taxable Fixed Income Division. He also started the Financial Futures and Options Department and headed the Mortgage and Real Estate Products Group.

In 2003, Fink helped to negotiate the resignation of the CEO of the New York Stock Exchange, Richard Grasso, who was widely criticized for his $190 million pay package. In 2006 Fink led the merger with Merrill Lynch Investment Managers, which doubled BlackRock's asset management portfolio. That same year, BlackRock's $5.4 billion purchase of Stuyvesant Town–Peter Cooper Village, a Manhattan housing complex, became the largest residential-real-estate deal in U.S. history. When the project ended in default, BlackRock clients lost their money, including the California Pension and Retirement System, which lost about $500 million.

Career, Business, and Investments

Early Career: Fink began his career at First Boston, where he gained experience in bond trading and portfolio management. His expertise in these areas laid the foundation for his future innovations in finance.

Founding BlackRock: In 1988, Fink co-founded BlackRock, focusing on combining risk management with innovative investment strategies. Today, BlackRock is the world's largest asset manager, overseeing more than $10 trillion in assets.

Vanity Fair reported in 2010 that Fink had increased First Boston's assets by about $1 billion. He was successful at the bank until 1986, when his department lost $100 million due to his incorrect prediction about interest rates. The experience influenced his decision to start a company that would invest clients' money while also incorporating comprehensive risk management.

In 1988, under the corporate umbrella of The Blackstone Group, Fink co-founded BlackRock and became its director and CEO. When BlackRock split from Blackstone in 1994, Fink retained his positions, becoming chairman in 1998 after BlackRock became independent. His other positions at the company have included chairman of the board, chairman of the executive and leadership committees, chair of corporate council and co-chair of the global client committee. BlackRock went public in 1999.

The U.S. government contracted BlackRock to aid its recovery after the 2008 financial crisis. Fink's longstanding relationships with senior government officials have led to questions about potential conflicts of interest regarding government contracts awarded without competitive bidding. BlackRock's contract led to relationships with Obama's first Treasury Secretary Tim Geithner and other members of the Obama economic recovery team. In 2016, Fink aspired to becoming Hillary Clinton's Treasury Secretary. Blackrock also hired many former executive branch appointees to its firm, strengthening its association with the federal government.

In December 2009, BlackRock purchased Barclays Global Investors, at which point the company became the largest money-management firm in the world. Despite his great influence, Fink is not widely known publicly, apart from his regular appearances on CNBC. BlackRock paid Fink $23.6 million in 2010, and $36 million in 2021. By 2016, BlackRock had $5 trillion under management, with 12,000 employees in 27 countries.

In December 2016, Fink joined a business forum assembled by then president-elect Donald Trump to provide strategic and policy advice on economic issues.

In his 2020 annual open letter, Fink announced environmental sustainability as core goal for BlackRock's future investment decisions. In this letter, he explained how climate will become a driver in economics, affecting all aspects of the economy. He also divulged in a separate letter (to investors) that BlackRock will be cutting ties with previous investments involving thermal coal and other investments that have a large environmental risk.

In his 2018 annual letter to shareholders, Fink stated that other companies should be aware of their impact on society; however, antiwar organizations were discontented with Fink's statement because his company, BlackRock, is the largest investor in weapon manufacturers through its U.S. Aerospace and Defense ETF. In September 2018, an activist with the U.S. non-profit organization Code Pink confronted Fink onstage at the Yahoo Finance All Markets Summit.

However, Fink has been largely vocal on companies taking action on climate change, and in an open letter in 2022 stated "Every company and every industry will be transformed by the transition to a net-zero world. The question is, will you lead, or will you be led?"

Social Network

While Larry Fink is not known for a prominent personal social media presence, his influence extends through BlackRock's corporate engagements and his participation in global financial forums like the World Economic Forum.

Education

- Bachelor of Arts in Political Science: UCLA, 1974.

- MBA in Real Estate: UCLA's Anderson School of Management, 1976.

Fink is on the board of trustees of New York University, where he holds various chairmanships including chair of the Financial Affairs Committee. He co-chairs the NYU Langone Medical Center board of trustees, and is a trustee of the Boys and Girls Club of New York. Fink is on the board of the Robin Hood Foundation. Fink founded the Lori and Laurence Fink Center for Finance & Investments at UCLA Anderson in 2009, and is its chairman.

Conclusion

Larry Fink's journey from a modest background to becoming one of the most influential figures in global finance is a testament to his strategic vision and leadership. His commitment to sustainable investing and his role as CEO of BlackRock continue to shape the financial world.