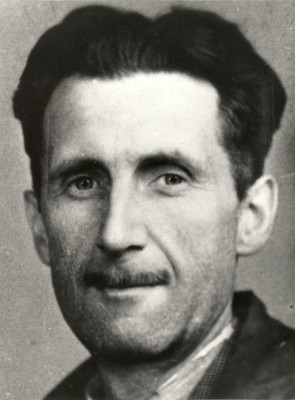

Age, Biography, and Wiki

George Soros was born György Schwartz on August 12, 1930, in Budapest, Hungary. He survived the Nazi occupation of Hungary and later moved to England in 1947. Soros is best known for his roles in finance and philanthropy, particularly through his Open Society Foundations.

| Occupation | Philosophers |

|---|---|

| Date of Birth | 12 August 1930 |

| Age | 95 Years |

| Birth Place | Budapest, Kingdom of Hungary |

| Horoscope | Leo |

| Country | Hungary |

Height, Weight & Measurements

There is limited publicly available information regarding Soros's height, weight, or body measurements. His public image is often highlighted by his intellectual and financial prowess rather than physical attributes.

| Height | |

| Weight | |

| Body Measurements | |

| Eye Color | |

| Hair Color |

Dating & Relationship Status

George Soros has been married three times: to Annaliese Witschak (1960-1983), Susan Weber (1983-2005), and Tamiko Bolton (2013-present). His personal life is often overshadowed by his professional achievements and philanthropic efforts.

Soros has wryly described his home as antisemitic. The family of his mother Erzsébet (also known as Elizabeth) operated a successful silk store. His father Tivadar (also known as Teodoro Ŝvarc) was a lawyer and a well-known Esperanto author who edited the Esperanto literary magazine Literatura Mondo and raised his son to speak the language. Tivadar had also been a prisoner of war during and after World War I until he escaped from Russia and rejoined his family in Budapest.

Soros' parents married in 1924. In 1936, Soros's family changed their name from the German-Jewish "Schwartz" to "Soros", as protective camouflage in increasingly antisemitic Hungary. Tivadar liked the new name because it is a palindrome and because of its meaning. In Hungarian, soros means "next"; in Esperanto it means "will soar".

Soros was 13 years old in March 1944 when Nazi Germany occupied Hungary. The Nazis barred Jewish children from attending school, and Soros and the other schoolchildren were made to report to the Judenrat ("Jewish Council"), which had been established during the occupation. Soros later described this time to writer Michael Lewis: The Jewish Council asked the little kids to hand out the deportation notices. I was told to go to the Jewish Council. And there I was given these small slips of paper ... I took this piece of paper to my father. He instantly recognized it. This was a list of Hungarian Jewish lawyers. He said, "You deliver the slips of paper and tell the people that if they report they will be deported". I'm not sure to what extent he knew they were going to be gassed. I did what my father said. Soros did not return to that job; his family survived the war by purchasing documents to say that they were Christians. Later that year at age 14, Soros posed as the Christian godson of an official of the collaborationist Hungarian government's Ministry of Agriculture, who himself had a Jewish wife in hiding. On one occasion, rather than leave the 14-year-old alone, the official took Soros with him while completing an inventory of a Jewish family's confiscated estate. Tivadar saved not only his immediate family, but also many other Hungarian Jews, and Soros later wrote that 1944 had been "the happiest [year] of his life", for it had given him the opportunity to witness his father's heroism. In 1945, Soros survived the Siege of Budapest, in which Soviet and German forces fought house-to-house through the city. George and his mother also spent some time hiding with the family of Elza Brandeisz and even attended their Lutheran church with them. When he was 17, Soros relocated to Paris before eventually moving to England. There he became a student at the London School of Economics. While a student of the philosopher Karl Popper, Soros worked as a railway porter and as a waiter, and once received £40 from a Quaker charity. Soros would sometimes stand at Speakers' Corner lecturing about the virtues of internationalism in Esperanto, which he had learned from his father. Soros obtained his Bachelor of Science in philosophy in 1951 and a Master of Science in philosophy in 1954 from the London School of Economics. After graduating, he wanted to stay in the university and work as a professor, but his grades were not high enough, prompting him to work for an investment firm in London.

In 1954, Soros began his financial career at the merchant bank Singer & Friedlander of London. He worked as a clerk and later moved to the arbitrage department. A fellow employee, Robert Mayer, suggested he apply at his father's brokerage house, F.M. Mayer of New York.

In August 2009, Soros donated $35 million to the state of New York to be earmarked for underprivileged children and given to parents who had benefit cards at the rate of $200 per child aged 3 through 17, with no limit as to the number of children that qualified. An additional $140 million was put into the fund by the state of New York from money they had received from the 2009 federal recovery act. Soros was an initial donor to the Center for American Progress, and he continues to support the organization through the Open Society Foundations.

| Parents | |

| Husband | Annaliese Witschak (m. 1960-1983) Susan Weber (m. 1983-2005) Tamiko Bolton (m. 2013) |

| Sibling | |

| Children |

Net Worth and Salary

As of May 2025, George Soros's net worth is estimated at $7.2 billion, with some sources suggesting it might be as high as $9 billion. He has donated over $32 billion to his Open Society Foundations, with $15 billion already distributed. His wealth primarily comes from his successful career in finance, particularly through his hedge funds.

George Soros (born György Schwartz; August 12, 1930) is an American investor and philanthropist. As of May 2025, he has a net worth of US$7.2 billion, having donated more than $32 billion to the Open Society Foundations, of which $15 billion has already been distributed, representing 64% of his original fortune. In 2020, Forbes called Soros the "most generous giver" in terms of percentage of net worth.

Born in Budapest to a non-observant Jewish family, Soros survived the Nazi occupation of Hungary and moved to the United Kingdom in 1947. He studied at the London School of Economics and was awarded a BSc in philosophy in 1951, and then a Master of Science degree, also in philosophy, in 1954. Soros started his career working in British and American merchant banks, before setting up his first hedge fund, Double Eagle, in 1969. Profits from this fund provided the seed money for Soros Fund Management, his second hedge fund, in 1970. Double Eagle was renamed Quantum Fund and was the principal firm Soros advised. At its founding, Quantum Fund had $12 million in assets under management, and as of 2011 it had $25 billion, the majority of Soros's overall net worth.

During the 1997 Asian financial crisis, the prime minister of Malaysia, Mahathir Mohamad, accused Soros of using the wealth under his control to punish the Association of Southeast Asian Nations (ASEAN) for welcoming Myanmar as a member. With a history of antisemitic remarks, Mahathir made specific reference to Soros's Jewish background ("It is a Jew who triggered the currency plunge") and implied Soros was orchestrating the crash as part of a larger Jewish conspiracy. Nine years later, in 2006, Mahathir met with Soros and afterward stated that he accepted that Soros had not been responsible for the crisis. In 1998's The Crisis of Global Capitalism: Open Society Endangered, Soros explained his role in the crisis as follows:

Career, Business, and Investments

Soros started his financial career in London and later moved to New York, where he founded Soros Fund Management in 1970. This firm eventually became the Quantum Fund, known for its extraordinary returns. Soros gained international fame in 1992 for short-selling the British pound, earning him the nickname "The Man Who Broke the Bank of England". He is also a significant shareholder in several companies, including JetBlue Airways and Integra Lifesciences Holdings Corp.

Soros is known as "The Man Who Broke the Bank of England" as a result of his short sale of US$10 billion worth of pounds sterling, which made him a profit of $1 billion, during the 1992 Black Wednesday UK currency crisis. Based on his early studies of philosophy, Soros formulated the general theory of reflexivity for capital markets, to provide insights into asset bubbles and fundamental/market value of securities, as well as value discrepancies used for shorting and swapping stocks.

Soros supports progressive and liberal political causes, to which he dispenses donations through the Open Society Foundations. Between 1979 and 2011, he donated more than $11 billion to various philanthropic causes; by 2017, his donations "on civil initiatives to reduce poverty and increase transparency, and on scholarships and universities around the world" totaled $12 billion. He influenced the fall of communism in Eastern Europe in the late 1980s and early 1990s, and provided one of Europe's largest higher education endowments to the Central European University in his Hungarian hometown. Soros's extensive funding of political causes has made him a "bugaboo of European nationalists". Numerous far-right theorists have promoted claims that characterize Soros as a dangerous "puppet master" behind alleged global plots. Criticisms of Soros, who is of Jewish descent, have often been called antisemitic conspiracy theories. In 2018, The New York Times reported that "conspiracy theories about him have gone mainstream, to nearly every corner of the Republican Party".

In a discussion at the Los Angeles World Affairs Council in 2006, Alvin Shuster, former foreign editor of the Los Angeles Times, asked Soros, "How does one go from an immigrant to a financier? ... When did you realize that you knew how to make money?". Soros replied, "Well, I had a variety of jobs and I ended up selling fancy goods on the seaside, souvenir shops, and I thought, that's really not what I was cut out to do. So, I wrote to every managing director in every merchant bank in London, got just one or two replies, and eventually that's how I got a job in a merchant bank."

From 1963 to 1973, Soros's experience as a vice president at Arnhold and S. Bleichroeder resulted in little enthusiasm for the job; business was slack following the introduction of the Interest Equalization Tax, which undermined the viability of Soros's European trading. He spent the years from 1963 to 1966 with his main focus on the revision of his philosophy dissertation. In 1966, he started a fund with $100,000 of the firm's money to experiment with his trading strategies.

In 1969, Soros set up the Double Eagle hedge fund with $4m of investors' capital including $250,000 of his own money. It was based in Curaçao, Dutch Antilles. Double Eagle itself was an offshoot of Arnhold and S. Bleichroeder's First Eagle fund established by Soros and that firm's chairman Henry H. Arnhold in 1967.

The fund announced in 2015 that it would inject $300 million to help finance the expansion of Fen Hotels, an Argentine hotel company. The funds will develop 5,000 rooms over the next three years throughout various Latin American countries.

Soros had been building a huge short position in pounds sterling for months leading up to the Black Wednesday of September 1992. Soros had recognized the unfavorable position of the United Kingdom in the European Exchange Rate Mechanism. For Soros, the rate at which the United Kingdom was brought into the European Exchange Rate Mechanism was too high, their inflation was also much too high (triple the German rate), and British interest rates were hurting their asset prices.

Finally, the UK withdrew from the European Exchange Rate Mechanism, devaluing the pound. Soros's profit on the bet was estimated at over $1 billion. He was dubbed "the man who broke the Bank of England". The estimated cost of Black Wednesday to the UK Treasury was £3.4 billion. Stanley Druckenmiller, who traded under Soros, originally saw the weakness in the pound and stated: "[Soros's] contribution was pushing him to take a gigantic position".

On October 26, 1992, The New York Times quoted Soros as saying: "Our total position by Black Wednesday had to be worth almost $10 billion. We planned to sell more than that. In fact, when Norman Lamont said just before the devaluation that he would borrow nearly $15 billion to defend sterling, we were amused because that was about how much we wanted to sell."

"The financial crisis that originated in Thailand in 1997 was particularly unnerving because of its scope and severity ... By the beginning of 1997, it was clear to Soros Fund Management that the discrepancy between the trade account and the capital account was becoming untenable. We sold short the Thai baht and the Malaysian ringgit early in 1997 with maturities ranging from six months to a year. (That is, we entered into contracts to deliver at future dates Thai baht and Malaysian ringgit that we did not currently hold.) Subsequently, Prime Minister Mahathir of Malaysia accused me of causing the crisis, a wholly unfounded accusation. We were not sellers of the currency during or several months before the crisis; on the contrary, we were buyers when the currencies began to decline—we were purchasing ringgits to realize the profits on our earlier speculation. (Much too soon, as it turned out. We left most of the potential gain on the table because we were afraid that Mahathir would impose capital controls. He did so, but much later.)"Also during this time, Soros, through his Soros Quantum Fund attempted to sell short the Hong Kong Dollar, using the similar strategies that he used during his bettings against the pound, baht, and peso. However, he lost most of the money shorted against the HKD.

"[N]obody who has read a business magazine in the last few years can be unaware that these days there really are investors who not only move money in anticipation of a currency crisis, but actually do their best to trigger that crisis for fun and profit. These new actors on the scene do not yet have a standard name; my proposed term is 'Soroi'."

In reaction to the Great Recession, he founded the Institute for New Economic Thinking in October 2009. This is a think tank composed of international economic, business, and financial experts, who are mandated to investigate radical new approaches to organizing the international economic and financial system.

In 1988, Soros was contacted by a French financier named Georges Pébereau, who asked him to participate in an effort to assemble a group of investors to purchase a large number of shares in Société Générale, a leading French bank that was part of a privatization program (something instituted by the new government under Jacques Chirac). Soros eventually decided against participating in the group effort, opting to personally move forward with his strategy of accumulating shares in four French companies: Société Générale, as well as Suez, Paribas, and the Compagnie Générale d'Électricité.

In 1989, the Commission des Opérations de Bourse (COB, the French stock exchange regulatory authority) conducted an investigation of whether Soros's transaction in Société Générale should be considered insider trading. Soros had received no information from the Société Générale and had no insider knowledge of the business, but he did possess knowledge that a group of investors was planning a takeover attempt. Initial investigations found Soros innocent, and no charges were brought forward. However, the case was reopened a few years later, and the French Supreme Court confirmed the conviction on June 14, 2006, although it reduced the penalty to €940,000.

Soros denied any wrongdoing, saying news of the takeover was public knowledge and it was documented that his intent to acquire shares of the company predated his own awareness of the takeover. In December 2006, he appealed to the European Court of Human Rights on various grounds, including that the 14-year delay in bringing the case to trial precluded a fair hearing. On the basis of Article 7 of the European Convention on Human Rights, stating that no person may be punished for an act that was not a criminal offense at the time that it was committed, the court agreed to hear the appeal. In October 2011, the court rejected his appeal in a 4–3 decision, saying that Soros had been aware of the risk of breaking insider trading laws.

Social Network

George Soros maintains a relatively low profile on social media platforms, focusing more on his philanthropic work and financial strategies. His influence is often seen through his philanthropic efforts and economic forecasts rather than personal social media presence.

In 1973, the Double Eagle Fund had $12 million and formed the basis of the Soros Fund. George Soros and Jim Rogers received returns on their share of capital and 20 percent of the profits each year.

In October 2011, a Reuters story, "Soros: not a funder of Wall Street Protests", was published after several commentators pointed out errors in an earlier Reuters story headlined "Who's Behind the Wall St. Protests?" with a lead stating that the Occupy Wall Street movement "may have benefited indirectly from the largesse of one of the world's richest men [Soros]". Reuters's follow-up article also reported a Soros spokesman and Adbusters' co-founder Kalle Lasn both saying that Adbusters—the reputed catalyst for the first Occupy Wall Street protests—had never received any contr

Education

Soros studied at the London School of Economics, where he earned a BSc in philosophy in 1951 and an MS in philosophy in 1954. His education under the mentorship of philosopher Karl Popper had a significant impact on his views on open societies.

Overall, George Soros's life reflects a blend of financial acumen, philanthropy, and intellectual pursuits, making him a celebrated figure in both the financial and social sectors.

In 1959, after three years at F. M. Mayer, Soros moved to Wertheim & Co. He planned to stay for five years, enough time to save $500,000, after which he intended to return to England to study philosophy. He worked as an analyst of European securities until 1963.

During this period, Soros developed the theory of reflexivity to extend the ideas of his tutor at the London School of Economics, Karl Popper. Reflexivity posits that market values are often driven by the fallible ideas of participants, not only by the economic fundamentals of the situation. Ideas and events influence each other in reflexive feedback loops. Soros argued that this process leads to markets having procyclical "virtuous" or "vicious" cycles of boom and bust, in contrast to the equilibrium predictions of more standard neoclassical economics.