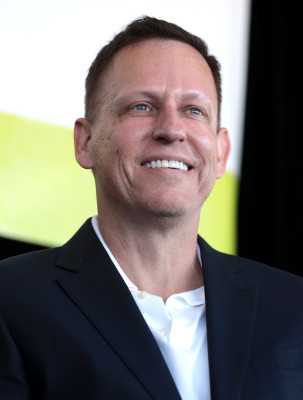

Age, Biography, and Wiki

Peter Thiel was born on October 11, 1967, in Frankfurt am Main, West Germany. His family moved to the United States when he was just one year old, settling in the Bay Area in the late 1970s. Thiel's early life was marked by academic excellence, particularly in mathematics, and he was valedictorian of his class at San Mateo High School in 1985.

| Occupation | Entrepreneur |

|---|---|

| Date of Birth | 11 October 1967 |

| Age | 58 Years |

| Birth Place | Frankfurt, West Germany |

| Horoscope | Libra |

| Country | Germany |

Height, Weight & Measurements

While specific details about Peter Thiel's height and weight are not widely documented, his focus on intellectual pursuits and entrepreneurial ventures has overshadowed physical attributes in his public persona.

Palantir's first backer was the Central Intelligence Agency's venture capital arm In-Q-Tel. The company steadily grew and in 2015 was valued at $20 billion, with Thiel being the company's largest shareholder.

| Height | |

| Weight | |

| Body Measurements | |

| Eye Color | |

| Hair Color |

Dating & Relationship Status

Peter Thiel's personal life is largely private, and there is limited public information available about his dating or relationship status.

The family emigrated to the United States when Peter was one year old and lived in Cleveland, Ohio, where his father worked as a chemical engineer. Klaus worked for various mining companies, which created an itinerant upbringing for Thiel and his younger brother, Patrick Michael Thiel. Thiel's mother became a U.S. citizen, but his father did not. Thiel eventually became a U.S. citizen as well.

Thiel studied philosophy at Stanford University. The replacement of a "Western Culture" program at Stanford with a "Culture, Ideas and Values" course that addressed diversity and multiculturalism prompted Thiel to co-found The Stanford Review, a conservative and libertarian newspaper, in 1987. The paper received funding from Irving Kristol. Thiel was The Stanford Review's first editor-in-chief until he graduated in 1989. Thiel has maintained his relationship with the paper, consulting with staff, donating to the newspaper, and placing graduating students in internships or jobs within his network.

Thiel married his long-time partner Matt Danzeisen in October 2017, in Vienna, Austria. Danzeisen works as a portfolio manager at Thiel Capital. Thiel was also in a long-term relationship with Jeff Thomas, a social media influencer, from the onset of the COVID-19 pandemic until Thomas's sudden death in March 2023. He resides in San Francisco, California.

During his time at Stanford University, Thiel attended a lecture given by René Girard. Girard, a Catholic, explained the role of sacrifice and the scapegoat mechanism in resolving social conflict, which appealed to Thiel as it offered a basis for his Christian faith without the fundamentalism of his parents.

| Parents | |

| Husband | Matt Danzeisen (m. October 2017) |

| Sibling | |

| Children |

Net Worth and Salary

As of recent estimates, Peter Thiel's net worth is approximately $7.5 billion, primarily due to his successful ventures like PayPal and Palantir Technologies, as well as his early investment in Facebook. His salary is not publicly disclosed, but his wealth stems from his various business and investment ventures.

Peter Andreas Thiel (born 11 October 1967) is an American entrepreneur, venture capitalist, and political activist. A co-founder of PayPal, Palantir Technologies, and Founders Fund, he was the first outside investor in Facebook. According to Forbes, as of May 2025, Thiel's estimated net worth stood at US$20.8 billion, making him the 103rd-richest individual in the world.

With Confinity, Thiel realized they could develop software to bridge a gap in making online payments. Although the use of credit cards and expanding automated teller machine networks provided consumers with more payment options, not all merchants had the necessary hardware to accept credit cards. Thus, consumers had to pay with exact cash or check. Thiel wanted to create a type of digital wallet for consumer convenience and security by encrypting data on digital devices, and in 1999 Confinity launched PayPal.

"We're definitely onto something big. The need PayPal answers is monumental. Everyone in the world needs money—to get paid, to trade, to live. Paper money is an ancient technology and an inconvenient means of payment. You can run out of it. It wears out. It can get lost or stolen. In the twenty-first century, people need a form of money that's more convenient and secure, something that can be accessed from anywhere with a PDA or an Internet connection. Of course, what we're calling 'convenient' for American users will be revolutionary for the developing world. Many of these countries' governments play fast and loose with their currencies. They use inflation and sometimes wholesale currency devaluations, like we saw in Russia and several Southeast Asian countries last year [referring to the 1998 Russian financial crisis and the 1997 Asian financial crisis], to take wealth away from their citizens. Most of the ordinary people there never have an opportunity to open an offshore account or to get their hands on more than a few bills of a stable currency like U.S. dollars. Eventually PayPal will be able to change this. In the future, when we make our service available outside the U.S. and as Internet penetration continues to expand to all economic tiers of people, PayPal will give citizens worldwide more direct control over their currencies than they ever had before. It will be nearly impossible for corrupt governments to steal wealth from their people through their old means because if they try the people will switch to dollars or Pounds or Yen, in effect dumping the worthless local currency for something more secure."

Career, Business, and Investments

Thiel's career path is marked by significant entrepreneurial achievements:

- Education and Early Career: Thiel studied philosophy at Stanford University, where he co-founded The Stanford Review. He later attended Stanford Law School, graduating in 1992.

- PayPal and Palantir: In 1998, Thiel co-founded Confinity, which merged with X.com to form PayPal. He became its CEO and chairman, leading to a successful sale to eBay in 2002. He also co-founded Palantir Technologies, a data analysis company.

- Investments: Thiel was an early investor in Facebook and has invested in numerous startups through his venture capital firm Founders Fund.

After graduating from Stanford, Thiel began his career as a clerk for Judge James Larry Edmondson, worked as a securities lawyer at Sullivan & Cromwell, a speechwriter for former U.S. secretary of education William Bennett, and a derivatives trader at Credit Suisse. He founded Thiel Capital Management in 1996 and co-founded PayPal with Max Levchin and Luke Nosek in 1998. He was the chief executive officer of PayPal until its sale to eBay in 2002 for $1.5 billion.

Through the Thiel Foundation, Thiel governs the grant-making bodies Breakout Labs and Thiel Fellowship, which fund non-profit research into artificial intelligence, life extension, and seasteading. In 2016, Thiel confirmed that he had funded Hulk Hogan in the Bollea v. Gawker lawsuit because Gawker had previously outed Thiel as gay. The lawsuit eventually bankrupted Gawker, and led to founder Nick Denton's bankruptcy.

Thiel played Dungeons & Dragons and was an avid reader of science fiction, with Isaac Asimov and Robert A. Heinlein among his favorite authors. He is a fan of J. R. R. Tolkien's works, stating as an adult that he had read The Lord of the Rings over ten times. Thiel has founded six firms (Palantir Technologies, Valar Ventures, Mithril Capital, Lembas LLC, Rivendell LLC and Arda Capital) with names originating from Tolkien.

After graduating from Stanford Law School, Thiel clerked for Judge James Larry Edmondson of the United States Court of Appeals for the 11th Circuit. Thiel then worked as a securities lawyer for Sullivan & Cromwell in New York. He left the law firm in under a year. He then took a job as a derivatives trader in currency options at Credit Suisse in 1993 while also working as a speechwriter for former United States Secretary of Education William Bennett. Thiel returned to California in 1996.

Upon returning to the Bay Area, Thiel capitalized on the dot-com boom. With financial support from friends and family, he raised $1 million toward the establishment of Thiel Capital Management and embarked on his venture capital career. Early on, he experienced a setback after investing $100,000 in his friend Luke Nosek's unsuccessful web-based calendar project. Soon thereafter, Nosek's friend Max Levchin described to Thiel his cryptography-related company idea, which became their first venture called Fieldlink (later renamed Confinity) in 1998.

When PayPal launched at a press conference in 1999, representatives from Nokia and Deutsche Bank sent $3 million in venture funding to Thiel using PayPal on their PalmPilots. PayPal then continued to grow through mergers in 2000 with Elon Musk's online financial services company X.com, and with Pixo, a company specializing in mobile commerce. These mergers allowed PayPal to expand into the wireless phone market and transformed it into a safer and more user-friendly tool by enabling users to transfer money via a free online registration and email rather than by exchanging bank account information. PayPal went public on 15 February 2002 and was bought by eBay for $1.5 billion in October of that year. Thiel remained CEO of the company until the sale. His 3.7% stake in the company was worth $55 million at the time of acquisition. In Silicon Valley circles, Thiel is colloquially referred to as the "Don of the PayPal Mafia".

Thiel used $10 million of his proceeds to create Clarium Capital Management, a global macro hedge fund focusing on directional and liquid instruments in currencies, interest rates, commodities, and equities. Thiel stated that "the big, macroeconomic idea that we had at Clarium—the idée fixe—was the peak-oil theory, which was basically that the world was running out of oil, and that there were no easy alternatives."

However, Clarium faltered in 2006 with a 7.8% loss. Thereafter, the firm sought to profit in the long-term from its petrodollar analysis, which foresaw the impending decline in oil supplies. Clarium's assets under management grew after achieving a 40.3% return in 2007 to more than $7 billion by the first quarter of 2008, but fell later in the year and again in 2009 after financial markets collapsed. By 2011, after missing out on the economic rebound, many key investors pulled out, reducing the value of Clarium's assets to $350 million, two thirds of which was Thiel's money.

In 2005, Thiel created Founders Fund, a San Francisco-based venture capital fund. Other partners in the fund include Sean Parker, Ken Howery, and Luke Nosek.

In 2017, Founders Fund bought about $15–20 million worth of bitcoin. In January 2018, the firm told investors that due to the cryptocurrency's surge the holdings were worth hundreds of millions of dollars.

Also in 2017, Thiel was one of the first outside investors in Clearview AI, a facial recognition technology startup that has raised concerns in the tech world and media for its risks of weaponization.

Through Valar Ventures, an internationally focused venture firm he cofounded with Andrew McCormack and James Fitzgerald, Thiel was an early investor in Xero, a software firm headquartered in New Zealand. Valar Ventures also invested in New Zealand-based companies Pacific Fibre and Booktrack.

In June 2012, he launched Mithril Capital Management, named after the fictitious metal in The Lord of the Rings, with Jim O'Neill and Ajay Royan. Unlike Clarium Capital, Mithril Capital, a fund with $402 million at the time of launch, targets companies that are beyond the startup stage and ready to scale up.

Thiel said he was motivated to sue Gawker after they published a 2007 article publicly outing him, headlined "Peter Thiel is totally gay, people." Thiel stated that Gawker articles about others, including his friends, had "ruined people's lives for no reason," and said, "It's less about revenge and more about specific deterrence." In response to criticism that his funding of lawsuits against Gawker could restrict the freedom of the press, Thiel cited his donations to the Committee to Protect Journalists and stated, "I refuse to believe that journalism means massive privacy violations. I think much more highly of journalists than that. It's precisely because I respect journalists that I do not believe they are endangered by fighting back against Gawker."

On 15 August 2016, Thiel published an opinion piece in The New York Times in which he argued that his defense of online privacy went beyond Gawker. He highlighted his support for the Intimate Privacy Protection Act and said that athletes and business executives have the right to stay in the closet as long as they want to.

Thiel is a member of the Steering Committee of the Bilderberg Group, a private, annual gathering of intellectual figures, political leaders, and business executives.

In December 2015, OpenAI, a nonprofit company aimed at the safe development of artificial general intelligence, announced that Thiel was one of its financial backers.

In November 2011, the Thiel Foundation announced the creation of Breakout Labs, a grant-making program intended "to fill the funding gap that exists for innovative research outside the confines of an academic institution, large corporation, or government." It offers grants of up to $350,000 to science-focused start-ups, "with no strings attached". In April 2012, Breakout Labs announced its first set of grantees. In total, 12 startups received funding, for a total of $4.5 million in grants. One of the first ventures to receive funding from Breakout Labs was 3Scan, a tissue imaging platform. The organization is now rebranded as Breakout Ventures.

Thiel's application cited his contribution to the economy—he had founded a venture capital fund in Auckland before applying, and had invested $7 million in two local companies—as well as a $1 million donation to the 2011 Christchurch earthquake appeal fund. Rod Drury, founder of Xero, also provided a formal reference for Thiel's application. Thiel's case was cited by critics as an example of how New Zealand passports can be bought, something the New Zealand government denied. At the time that his citizenship was revealed, The New Zealand Herald came out with the report that the New Zealand Defence Force, the Security Intelligence Service, and the Government Communications and Security Bureau have long-standing links with Thiel's Palantir.

In 2015, Thiel purchased a 193 hectare estate near Wānaka, which fit the classification of "sensitive land" and required foreign buyers to obtain permission from New Zealand's Overseas Investment Office. Thiel did not require permission, as he was a citizen.

In 1995, the Independent Institute published The Diversity Myth: Multiculturalism and the Politics of Intolerance at Stanford, which Thiel co-authored along with fellow tech entrepreneur David O. Sacks, and with a foreword by the late Emory University historian Elizabeth Fox-Genovese. The book is critical of political correctness and multiculturalism in higher education and alleges that it has diluted academic rigor. Thiel and Sacks' writings drew criticism from then-Stanford Provost Condoleezza Rice and then-Stanford President Gerhard Casper in describing Thiel and Sacks' view of Stanford as "a cartoon, not a description of our freshman curriculum", and their commentary as "demagoguery, pure and simple".

In spring 2012, Thiel taught the class CS 183: Startup at Stanford University. Notes for the course, taken by student Blake Masters, led to a book titled Zero to One: Notes on Startups, or How to Build the Future by Thiel and Masters, which was released in September 2014. Thiel later endorsed Masters' campaign in the 2022 United States Senate election in Arizona, donating more than $10 million.

Derek Thompson, writing for The Atlantic, stated Zero to One "might be the best business book I've read". He described it as a "self-help book for entrepreneurs, bursting with bromides" but also as a "lucid and profound articulation of capitalism and success in the 21st century economy."

Social Network

Thiel is not known for a strong presence on traditional social media platforms. However, he is active in public discourse through interviews, speeches, and articles published in prominent outlets like The Wall Street Journal and Forbes.

Following PayPal, Thiel founded Clarium Capital, a global macro hedge fund based in San Francisco. In 2003, he launched Palantir Technologies, a big data analysis company, and has been its chairman since its inception. In 2005, Thiel launched Founders Fund with PayPal partners Ken Howery and Luke Nosek. Thiel became Facebook's first outside investor when he acquired a 10.2% stake in the company for $500,000 in August 2004. He sold the majority of his shares in Facebook for over $1 billion in 2012, and stepped down from the board of directors in 2022. He co-founded Valar Ventures in 2010, co-founded Mithril Capital, was investment committee chair, in 2012, and was a part-time partner at Y Combinator from 2015 to 2017.

In May 2003, Thiel incorporated Palantir Technologies, a big data analysis company named after the Tolkien artifact. He continues as its chairman, as of 2022. Thiel stated that the idea for the company was based on the realization that "the approaches that PayPal had used to fight fraud could be extended into other contexts, like fighting terrorism". He also stated that, after the September 11 attacks, the debate in the United States was "will we have more security with less privacy or less security with more privacy?". He envisioned Palantir as providing data mining services to government intelligence agencies that were maximally unintrusive and traceable.

In August 2004, Thiel made a $500,000 angel investment in Facebook for a 10.2% stake in the company and joined Facebook's board. This was the first outside investment in Facebook and valued the company at $4.9 million. As a board member, Thiel was not actively involved in Facebook's operations. He provided help with timing the various rounds of funding and Zuckerberg credited Thiel with helping him time Facebook's 2007 Series D, which closed before the 2008 financial crisis.

In his book The Facebook Effect, David Kirkpatrick outlines how Thiel came to make this investment: Napster co-founder Sean Parker, who at the time had assumed the title of "President" of Facebook, was seeking investors. Parker approached Reid Hoffman, the CEO of work-based social network LinkedIn. Hoffman liked Facebook but declined to become lead investor because of the potential for conflict of interest. Hoffman directed Parker to Thiel, whom he knew from their PayPal days. Thiel met Parker and Facebook founder Mark Zuckerberg. Thiel and Zuckerberg got along well, and Thiel agreed to lead Facebook's seed round with $500,000 for 10.2% of the company. The investment was originally in the form of a convertible note, to be converted to equity if Facebook reached 1.5 million users by the end of 2004. Although Facebook narrowly missed the target, Thiel allowed the loan to be converted to equity anyway. Thiel said of his investment: "I was comfortable with them pursuing their original vision. And it was a very reasonable valuation. I thought it was going to be a pretty safe investment."

In September 2010, Thiel, while expressing skepticism about the potential for growth in the consumer Internet sector, argued that relative to other Internet companies, Facebook (which then had a secondary market valuation of $30 billion) was comparatively undervalued. Facebook's initial public offering was in May 2012, with a market cap of nearly $100 billion ($38 a share), at which time Thiel sold 16.8 million shares for $638 million. In August 2012, immediately upon the conclusion of the early investor lock-up period, Thiel sold almost all of his remaining stake for between $19.27 and $20.69 per share, or $395.8 million, for a total of more than $1 billion. He retained his seat on the board of directors. In 2016, he sold a little under 1 million of his shares for around $100 million. In November 2017, he sold another 160,805 shares for $29 million, putting his holdings in Facebook at 59,913 Class A shares. As of April 2020, he owned less than 10,000 shares in Facebook.

On 7 February 2022, Thiel announced he would not stand for re-election to the board of Facebook owner Meta at the 2022 annual stockholders' meeting and would leave after 17 years in order to support pro–Donald Trump candidates in the 2022 United States elections.

In addition to Facebook, Thiel made early-stage investments in numerous startups (personally or through Founders Fund), including Airbnb, Slide.com, LinkedIn, Friendster, RapLeaf, Geni.com, Yammer, Yelp Inc., Spotify, Powerset, Practice Fusion, MetaMed, Vator, SpaceX, Palantir Technologies, IronPort, Votizen, Asana, Big Think, CapLinked, Quora, Nanotronics Imaging, Rypple, TransferWise, Stripe, Block.one, and AltSchool. Thiel also backed DeepMind, a UK start-up that was acquired by Google in early 2014 for £400 million.

In 2012, Thiel, along with Nosek and Scott Banister, put their support behind the Endorse Liberty Super PAC. Collectively they gave $3.9 million to Endorse Liberty, whose purpose was to promote Ron Paul. As of 31 January 2012, Endorse Liberty reported spending about $3.3 million promoting Paul by setting up two YouTube channels, buying ads from Google, Facebook and StumbleUpon, and building a presence on the Web. After Paul again failed to secure the nomination in the 2012 United States presidential election, Thiel contributed to the Mitt Romney/Paul Ryan presidential ticket of 2012.

"I feel I was personally very guilty of this; you don't know what to do with your life, so you get a college degree; you don't know what you're going to do with your college degree, so you get a graduate degree. In my case, it was law school, which is the classic thing one does when one has no idea what else to do. I don't have any big regrets, but if I had to do it over I would try to think more about the future than I did at the time... You cannot get out of student debt even if you personally go bankrupt, it's a form of almost like indentured servitude, it's attached to your physical person for the rest of your life."

In 2021, it was revealed by ProPublica that Thiel had purchased 1.7 million founder's shares in the entity that would become PayPal using $1,700 in a Roth IRA in 1999. Due to the rapid growth in the value of the shares as PayPal grew and was later acquired by eBay, Thiel's $1,700 investment grew to over $5 billion as of 2019. Most of this increase in the value of the Roth was due to him re-investing his PayPal proceeds into companies like Palantir and Facebook which grew quickly after his investment. Unlike a traditional IRA, in a Roth IRA, contributions are taxed initially, allowing for later tax-free withdrawal. As such, Thiel paid taxes on his initial $1,700 deposit, allowing him to potentially withdraw the $5 billion balance tax-free after age 59½.

Education

- Stanford University: Thiel studied philosophy, graduating in 1989.

- Stanford Law School: He earned his Juris Doctor degree in 1992.

Peter Thiel's intellectual and entrepreneurial pursuits have made him a pivotal figure in Silicon Valley, with a legacy that spans both technology and philosophy.

Before settling in Foster City, California, in 1977, the Thiel family lived in South Africa and South West Africa (modern-day Namibia). Peter changed elementary schools seven times. He attended a German-language school in Swakopmund that required students to wear uniforms and utilized corporal punishment, such as striking students' hands with a ruler. He said this experience instilled a distaste for uniformity and regimentation later reflected in his support for individualism and libertarianism. The German community in Swakopmund that Thiel grew up in was known at the time for its continued glorification of Nazism.

Thiel excelled in mathematics and scored first in a California-wide mathematics competition while attending Bowditch Middle School in Foster City. At San Mateo High School, he read Ayn Rand and admired the optimism and anti-communism of then-President Ronald Reagan. He was valedictorian of his graduating class in 1985.

Thiel enrolled in Stanford Law School and earned his juris doctor degree in 1992. While at Stanford, Thiel met René Girard, whose mimetic theory influenced him.

Thiel is a self-described conservative libertarian. Since the late 2010s, he has espoused support for national conservatism, and criticized economically liberal attitudes towards free trade and big tech. In 2014, he authored an opinion piece in the Wall Street Journal headlined "Competition Is for Losers", and gave a Y Combinator lecture by the same title, in which he advised companies to maximize profits by seeking out a monopoly.

In 1995, Thiel and David O. Sacks published The Diversity Myth, a book that criticized political correctness and multiculturalism in higher education. The following year, writing for Stanford Magazine, they argued against affirmative action in the United States, saying that it had hurt, not helped, the "disadvantaged" and had led to increased segregation at Stanford University in the name of "diversity".

In 2009, it was reported that Thiel helped fund college student James O'Keefe's "Taxpayers Clearing House" video—a satirical look at the Wall Street bailout. O'Keefe went on to produce the ACORN undercover sting videos; however, through a spokesperson, Thiel denied involvement in the ACORN sting.

On 29 September 2010, Thiel created the Thiel Fellowship, which annually awards $100,000 to 20 people under the age of 23 in order to spur them to drop out of college and create their own ventures. According to Thiel, for many young people, college is the path to take when they have no idea what to do with their lives:

Thiel began playing chess at the age of six and was at one time one of the top junior players in the United States. He holds the title of Life Master, but he has not competed since 2003. On 30 November 2016, Thiel made the ceremonial first move in the first tiebreak game of the World Chess Championship 2016 between Sergey Karjakin and Magnus Carlsen.

* In 2012, Students For Liberty, an organization dedicated to spreading libertarian ideals on college campuses, awarded Thiel its "Alumnus of the Year" award.

Thiel also has a chapter giving advice in Tim Ferriss' self-help book Tools of Titans: The Tactics, Routines, and Habits of Billionaires, Icons, and World-Class Performers.

In 2009, Thiel published The Education of a Libertarian on Cato Institute's blog, in which he says that he no longer believes that "freedom and democracy are compatible". Adam Rogers contends that this essay has prefigured the Department of Government Efficiency project.