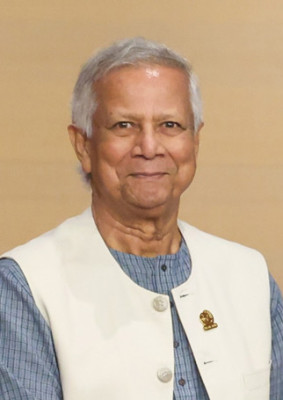

Age, Biography, and Wiki

Muhammad Yunus was born in Hathazari, Chittagong, which is now part of Bangladesh. He is known for his groundbreaking work in microfinance, which has helped millions of people globally. As of 2025, Yunus is 84 years old and has been a key figure in Bangladesh's economic and social development. His role as the Chief Adviser of the interim government began in August 2024, following significant political unrest in the country.

| Occupation | Entrepreneur |

|---|---|

| Date of Birth | 28 June 1940 |

| Age | 85 Years |

| Birth Place | Hathazari, Bengal Province, British India |

| Horoscope | Cancer |

| Country | India |

Height, Weight & Measurements

There is no publicly available information on Muhammad Yunus's height, weight, or body measurements.

| Height | |

| Weight | |

| Body Measurements | |

| Eye Color | |

| Hair Color |

Dating & Relationship Status

Yunus has been married to Afrozi Yunus until her death in 2017. He has a daughter, Monica Yunus, who is also involved in social work and philanthropy.

His father was Haji Muhammad Dula Mia Saudagar, a Sufi jeweller, and his mother was Sufia Khatun. His early childhood was spent in the village. In 1944, his family moved to the city of Chittagong, and he moved from his village school to Lamabazar Primary School. By 1949, his mother was afflicted with psychological illness. Later, he passed the matriculation examination from Chittagong Collegiate School ranking 16th out of 39,000 students in East Pakistan. During his school years, he was an active Boy Scout, and travelled to West Pakistan and India in 1952, and to Canada in 1955 to attend Jamborees. Later, while Yunus was studying at Chittagong College, he became active in cultural activities and won awards for drama. In 1957, he enrolled in the Department of Economics at Dhaka University and completed his BA in 1960 and MA in 1961.

For many years, Yunus remained a follower of Hasina's father, Sheikh Mujib, Former President of Bangladesh. While teaching at Middle Tennessee State University, Yunus founded the Bangladesh Citizens' Committee (BCC) as a response to West Pakistan's aggression against Bangladesh. After the outbreak of the war of liberation, the BCC selected Yunus to become editor of its Bangladesh News Letter. Inspired by the birth of Bangladesh in 1971, Yunus returned home in 1972. The relationship continued after Mujib's death. Yunus maintained a professional relationship with Hasina. Yunus appointed Hasina—along with U.S. First Lady Hillary Clinton—as co-chair of a microcredit summit held 2–4 February 1997. At this event, 50 heads of state and high-level officials from 137 nations gathered in Washington, DC, to discuss solutions to poverty. At this event, Hasina had nothing but praise for Yunus. In her statement she praised, "the outstanding work done by Professor Yunus and the Grameen Bank he founded. ... The success of the Grameen Bank has created optimism about the viability of banks engaged in extending micro-credit to the poor". The inaugural ceremony of Grameen Phone, Bangladesh's largest telephone service, took place at Hasina's office on 26 March 1997. Using Grameen Phone, Hasina made the first call to Thorbjorn Jagland, the then-Norwegian prime minister. When her conversation ended, she received another call, from Laily Begum, a Grameen Phone employee. However, this long relationship ended in 2007 after Yunus disclosed his intention to form a political party, Nagorik Shakti.

Yunus identifies as a Muslim and has expressed the importance that salah and Ishq-e-Muhammadi holds to him in his personal life. His father, Haji Muhammad Dula Mia Saudagar, completed Hajj three times and was a disciple of two prominent Sufis of Chittagong. Yunus continues to actively display a normative orthodox Sunnite theological creed, whilst rejecting superstition. He encourages the public to engage in Dua directly to Allah, whom Yunus publicly recognises as the supreme source of assistance and support, and as the master of Divine Decree. Yunus has also referred to the Qur'an as the "guide for mankind" and acknowledged the concept of ummah in his public speeches.

| Parents | |

| Husband | Vera Forostenko (m. 1970-1979) Afrozi Yunus (m. 1983) |

| Sibling | |

| Children |

Net Worth and Salary

Muhammad Yunus's net worth is estimated to be around $10 million. However, some reports suggest that his actual wealth may be significantly higher.

In 1976, during visits to the poorest households in the village of Jobra near Chittagong University, Yunus discovered that very small loans could make a disproportionate difference to a poor person. Village women who made bamboo furniture had to take usurious loans to buy bamboo, and repay their profits to the lenders. Traditional banks did not want to make tiny loans at reasonable interest to the poor due to high risk of default. But Yunus believed that, given the chance, the poor will not need to pay high interest on the money, can keep any profits from their own labour, and hence microcredit was a viable business model. Yunus lent US$27 of his money to 42 women in the village, who made a profit of BDT 0.50 (US$0.02) each on the loan. Thus, Yunus is credited with the idea of microcredit.

The success of the Grameen microfinance model inspired similar efforts in about 100 developing countries and even in developed countries including the United States. Many microcredit projects retain Grameen's emphasis of lending to women. More than 94% of Grameen loans have gone to women, who suffer disproportionately from poverty and who are more likely than men to devote their earnings to their families.

Hasina launched a series of trials against Yunus. The former put the latter on trial in 2010 and ultimately removed him from Grameen Bank, citing his age. In 2013, he was tried a second time, because he had supposedly received earnings without the necessary government permission, including his Nobel Peace Prize earnings and royalties from his book sales. The series of trials against Yunus puzzled figures worldwide, from the 8.3 million underprivileged women served by Grameen Bank to U.S. President Barack Obama.

On 2 August 2012, Sheikh Hasina approved a draft of "Grameen Bank Ordinance 2012" to increase government control over the bank. That power resided with the bank's directors—nine poor women who were elected by 8.3 million Grameen borrowers. Hasina also ordered a fresh investigation into Yunus's activities and financial transactions in his later years as managing director of Grameen, but people saw the move as an attempt to destroy his image. The prime minister also alleged that Yunus had received his earnings without the necessary permission from the government, including his Nobel Peace Prize earnings and book royalties.

Career, Business, and Investments

Yunus's career is marked by his pioneering work in microfinance. He founded the Grameen Bank in 1983, which provides small loans to the poor without collateral. This model has been replicated in over 100 countries and has empowered countless individuals worldwide. Yunus has received numerous awards, including the Nobel Peace Prize in 2006, the Presidential Medal of Freedom in 2009, and the Congressional Gold Medal in 2010. In addition to his work with Grameen Bank, Yunus is involved in various social business initiatives and has co-founded the Yunus Social Business – Global Initiatives.

Muhammad Yunus (born 28 June 1940) is a Bangladeshi economist, entrepreneur, and civil society leader who has been serving as the Chief Adviser of the interim government of Bangladesh since 8 August 2024. Yunus pioneered the modern concept of microcredit and microfinance, for which he was awarded the Nobel Peace Prize in 2006 as the first Bangladeshi. He is the founder of Grameen Bank.

In 2012, Yunus became Chancellor of Glasgow Caledonian University in Scotland, a position he held until 2018. Previously, he was a professor of economics at Chittagong University in Bangladesh. He published several books related to his finance work. He is a founding board member of Grameen America and Grameen Foundation, which supports microcredit. Yunus also served in the board of directors of the United Nations Foundation, a public charity to support UN causes, from 1998 to 2021. In 2022, he partnered with Global Esports Federation as part of the Esports for Development (E4D) movement to support the development of esports.

For his work with Grameen, Yunus was named an Ashoka: Innovators for the Public Global Academy Member in 2001. According to Rashidul Bari, the Grameen's social business model has gone from being theory to an inspiring practice adopted globally by leading universities, entrepreneurs, social business and corporations.

As Chief Adviser, Yunus has pledged to continue providing humanitarian aid to Rohingya refugees in Bangladesh and support the garment industry amid disruptions caused by the unrest prior to his appointment.

The lure of profits attracted some for-profit MFIs to hold initial public offerings (IPOs), including the largest Indian MFI, SKS Microfinance, which held an IPO in July 2010. In September 2010, Yunus criticised the IPO; in a debate with SKS founder Vikram Akula during the Clinton Global Initiative meeting, he said, "Microcredit is not about exciting people to make money off the poor. That's what you're doing. That's the wrong message completely." Calculations of actual interest rate vary, but one estimate puts average Grameen rates at about a 23% interest rate (comparable to the inflation rate). Also see what annual interest do NGOs earn from a fixed initial capital?

On 27 January 2011, Yunus appeared in court in a food-adulteration case filed by the Dhaka City Corporation (DCC) Food Safety Court, accusing him of producing an "adulterated" yogurt whose fat content was below the legal minimum. This yogurt is produced by Grameen Danone, a social business joint venture between Grameen Bank and Danone that aims to provide opportunities for street vendors who sell the yogurt and to improve child nutrition with the nutrient-fortified yogurt. According to Yunus' lawyer, the allegations are "false and baseless".

"The government of Bangladesh has played its trump card in its long-running campaign against Grameen Bank and its founder Muhammad Yunus. Last week, legislators passed a law that effectively nationalizes the bank, which pioneered the idea of making small loans to poor women, by wresting control of it from the 8.4 million rural women that own a majority of its shares."

On 11 January 2007, Army General Moeen U Ahmed staged a military coup. Meanwhile, Yunus turned down his request to become the nation's fourth Chief Advisor after Khaleda Zia's term ended. Yunus, however, suggested the general pick Fakhruddin Ahmed for the job. Fakhruddin took office on 11 January 2007 and made it clear on his first day that he intended not only to arrange a free and fair election but also to clean up corruption. While Khaleda and Hasina criticised Fakruddin and claimed that it was not his job to clean up corruption, Yunus expressed his satisfaction. In an interview with the AFP news agency, Yunus remarked "There is no ideology here." Hasina had a harsh reaction to Yunus's comments, calling him a "usurer who has not only failed to eradicate poverty but has also nurtured poverty. " This was Hasina's first public statement against Yunus. Later Yunus announced the name of this prospective political party, Nagorik Shakti (Citizens' Power), saying he had a mission to enter the political arena in his nation in hope of changing its identity from "bottomless basket" to "rising tiger". However, on 3 May, Yunus published a third open letter and put his political ambitions to rest.

The Bangladesh government launched the first trial against Yunus in December 2010, alleging that in 1996 he had transferred approximately $100 million to a sister company of Grameen Bank. Yunus denied the allegations and he was found innocent by the Norwegian government.

"Since then, the government has started an investigation into the bank and is now planning to take over Grameen—a majority of whose shares are owned by its borrowers—and break it up into 19 regional lenders."

Yunus's brother Muhammad Ibrahim is a former professor of physics at the University of Dhaka and the founder of The Center for Mass Education in Science (CMES), which brings science education to adolescent girls in villages. His other brother Muhammad Jahangir (d. 2019) was a television presenter and a social activist in Bangladesh.

The Yunus Centre, located in Dhaka, Bangladesh, is a think tank focused on social business, poverty alleviation, and sustainability. Founded in 2008 and chaired by Dr Yunus, it promotes his philosophy of social business and serves as a resource center for related initiatives. The centre's activities include poverty eradication campaigns, research and publications, support for social business start-ups, organizing the Global Social Business Summit, and developing academic programs on social business with international universities.

* Yunus, Muhammad, Moingeon, Bertrand and Laurence Lehmann-Ortega (2010), "Building Social Business Models: Lessons from the Grameen Experience", April–June, vol 43, number 2–3, Long Range Planning, pp. 308–325

* Yunus, Muhammad, Moingeon, Bertrand and Laurence Lehmann-Ortega (2010), "Building Social Business Models: Lessons from the Grameen Experience", April–June, vol 43, number 2–3, Long Range Planning, pp. 308–325

* Yunus, Muhammad, Moingeon, Bertrand and Laurence Lehmann-Ortega (2010), "Building Social Business Models: Lessons from the Grameen Experience", April–June, vol 43, number 2–3, Long Range Planning, pp. 308–325

* Yunus, Muhammad, Moingeon, Bertrand and Laurence Lehmann-Ortega (2010), "Building Social Business Models: Lessons from the Grameen Experience", April–June, vol 43, number 2–3, Long Range Planning, pp. 308–325

* Yunus, Muhammad, Moingeon, Bertrand and Laurence Lehmann-Ortega (2010), "Building Social Business Models: Lessons from the Grameen Experience", April–June, vol 43, number 2–3, Long Range Planning, pp. 308–325

* Yunus, Muhammad, Moingeon, Bertrand and Laurence Lehmann-Ortega (2010), "Building Social Business Models: Lessons from the Grameen Experience", April–June, vol 43, number 2–3, Long Range Planning, pp. 308–325

* Yunus, Muhammad, Moingeon, Bertrand and Laurence Lehmann-Ortega (2010), "Building Social Business Models: Lessons from the Grameen Experience", April–June, vol 43, number 2–3, Long Range Planning, pp. 308–325

* Yunus, Muhammad, Moingeon, Bertrand and Laurence Lehmann-Ortega (2010), "Building Social Business Models: Lessons from the Grameen Experience", April–June, vol 43, number 2–3, Long Range Planning, pp. 308–325

Social Network

Muhammad Yunus maintains a strong presence on social media, though specific details about his personal accounts are not widely available. However, his work and initiatives are frequently discussed and shared across various platforms by his supporters and organizations he is associated with.

During the Bangladesh Liberation War in 1971, Yunus founded a citizen's committee and ran the Bangladesh Information Center, with other Bangladeshis in the United States, to raise support for liberation. He also published the Bangladesh Newsletter from his home in Nashville. After the War, he returned to Bangladesh and was appointed to the government's Planning Commission headed by Nurul Islam. However, he found the job boring and resigned to join Chittagong University as head of the Economics department. After observing the famine of 1974, he became involved in poverty reduction and established a rural economic programme as a research project. In 1975, he developed a Nabajug Tebhaga Khamar (lit. 'New Era Three-share Farm') which the government adopted as the Packaged Input Programme. To make the project more effective, Yunus and his associates proposed the Gram Sarkar (lit. 'Village government') programme. Introduced by President Ziaur Rahman in the late 1970s, the government formed 40,392 village governments as a fourth layer of government in 2003. On 2 August 2005, in response to a petition by Bangladesh Legal Aid and Services Trust (BLAST), the High Court declared village governments illegal and unconstitutional.

In the late 1980s, Grameen started to diversify by attending to underutilized fishing ponds and irrigation pumps like deep tube wells. In 1989, these diversified interests started growing into separate organisations. The fisheries project became Grameen Motsho ("Grameen Fisheries Foundation") and the irrigation project became Grameen Krishi ("Grameen Agriculture Foundation"). In time, the Grameen initiative grew into a multi-faceted group of profitable and non-profit ventures, including major projects like Grameen Trust and Grameen Fund, which runs equity projects like Grameen Software Limited, Grameen CyberNet Limited, and Grameen Knitwear Limited, as well as Grameen Telecom, which has a stake in Grameenphone (GP), the biggest private phone company in Bangladesh. From its start in March 1997 to 2007, GP's Village Phone (Polli Phone) project had brought cell-phone ownership to 260,000 rural poor in over 50,000 villages.

Yunus was the first Bangladeshi to ever get a Nobel Prize. He established Grameen Bank in 1983, which plays a significant role in poverty alleviation in various countries of the world including Bangladesh. In 2006, he and the Grameen Bank he founded jointly won the Nobel Peace Prize. After receiving the news of the important award, Yunus announced that he would use part of his share of the $1.4 million (equivalent to $ million in ) award money to create a company to make low-cost, high-nutrition food for the poor; while the rest would go towards establishing the Yunus Science and Technology University in his home district as well as setting up an eye hospital for the poor in Bangladesh.

He has played a key advisory role in the Paris 2024 Olympics, promoting social business principles and encouraging sustainable, socially responsible projects. His influence led to initiatives like prioritizing social businesses in public tenders and integrating social housing into the athletes' village redevelopment.

Education

Yunus holds a BA from the University of Dhaka and later earned his PhD in economics from Vanderbilt University in the United States. His educational background has been instrumental in shaping his career and vision for microfinance.

Born in Hathazari, Chittagong, Yunus passed his matriculation and intermediate examinations from Chittagong Collegiate School and Chittagong College, respectively. He completed his BA from University of Dhaka and joined as a lecturer in Chittagong College. He obtained his PhD in economics from Vanderbilt University in the United States.

Following the overthrow of Sheikh Hasina, President Mohammed Shahabuddin gave Yunus a mandate to form an interim government, acceding to calls from student leaders for his appointment. His government has appointed a Constitutional Reform Commission to draft revisions to the Constitution of Bangladesh and has pledged to hold the next general election by June 2026. His name was listed in The 500 Most Influential Muslims in 2024. In 2025, he was named one of Time Magazine's 100 Most Influential People in the World.

After his graduation, Yunus joined the Bureau of Economics at Dhaka University as a research assistant to economists Nurul Islam and Rehman Sobhan. Later, he was appointed lecturer in economics in Chittagong College in 1961. During that time, he also set up a profitable packaging factory on the side. In 1965, he received a Fulbright scholarship to study in the United States. He obtained his PhD in economics from Vanderbilt University through their Graduate Program in Economic Development in 1969. From 1969 to 1972, Yunus was an assistant professor of economics at Middle Tennessee State University in Murfreesboro.

In 1996, Muhammad Yunus served as an advisor to the caretaker government led by former Chief Justice Muhammad Habibur Rahman. He was responsible for overseeing the Ministry of Primary and Mass Education, the Ministry of Science and Technology, and the Ministry of Environment and Forests.

Amid the Student–People's uprising in Bangladesh, Yunus expressed support for the students and his distaste of the current government, and in August 2024, after the resignation of Sheikh Hasina and her departure to India, it was announced that Yunus would be chief adviser of the interim government.

Muhammad Yunus was appointed as the transitional leader of the interim government on 7 August 2024 by president Mohammed Shahabuddin. On 8 August 2024, he took the oath and has been serving as the Chief Advisor of the interim government. After the oath, he visited injured people in Dhaka Medical College. On 10 August 2024, he visited the home and family members of Abu Sayed. He also visited injured student protesters in the Rangpur Medical College. Following communal violence after Hasina's resignation, Yunus threatened to resign if the violence continued and vowed to crack down on conspirators of the attacks.

Yunus emphasized that satellite internet through Starlink would allow broader access to education, health services, and entrepreneurship, especially in rural and underserved regions. He also expressed interest in collaborating with Elon Musk to unlock Bangladesh’s potential through digital innovation.

Following his appointment as chief adviser, Yunus faced criticism after several Grameen-affiliated institutions received government approvals and benefits. These included approval for Grameen University, tax waivers and a reduction in government shareholding in Grameen Bank, and licenses for manpower export and a digital wallet. The dismissal of labor law violation and money laundering cases against him during this period also raised concerns from some quarters regarding transparency and conflicts of interest.

In 1967, while Yunus attended Vanderbilt University, he met Vera Forostenko, a student of Russian literature at Vanderbilt University and daughter of Russian immigrants to Trenton, New Jersey, United States. They were married in 1970. Yunus's marriage with Vera ended within months of the birth of their baby girl, Monica Yunus, in 1979 in Chittagong, as Vera returned to New Jersey claiming that Bangladesh was not a good place to raise a baby. Monica Yunus became an operatic soprano based in New York City. Yunus later married Afrozi Yunus, who was then a researcher in physics at Manchester University. She was later appointed as a professor of physics at Jahangirnagar University.

Former U.S. president Bill Clinton was a vocal advocate for the awarding of the Nobel Prize to Yunus. He expressed this in Rolling Stone magazine as well as in his autobiography My Life. In a speech given at University of California, Berkeley in 2002, President Clinton described Yunus as "a man who long ago should have won the Nobel Prize [in Economics and] I'll keep saying that until they finally give it to him." Conversely, The Economist stated explicitly that while Yunus was doing excellent work to fight poverty, it was not appropriate to award him the Peace Prize, stating: "... the Nobel committee could have made a braver, more difficult, choice by declaring that there would be no recipient at all."

Conclusion

Muhammad Yunus is a figure of great influence and achievement, known globally for his contributions to social and economic development. His work continues to inspire and empower communities worldwide.